Over the last few months I have had an opportunity to plan and work with grade 7 students on a financial literacy unit in collaboration with some amazing educators. The teachers and I had an opportunity to collaborate and put together a cross curriculuar financial literacy unit. We began the unit with students by exploring various career options after taking some peronality tests on My Blueprint. Students chose three possible careers to explore in depth, finally selecting one career to explore in more detail and examine the pathway to that area. Students were also introduced to resumes and created their own on My Blueprint as part of their language arts program.

Next students were introduced to and explored saving and investing through a lesson that was adapted and found on Nearpod. Students learned to differentiate between saving and chequing accounts, analyze what is important when creating saving goals, and list the proper steps to creating and accomplishing saving goals. Students also examined their attitudes in saving for money using a Google Form that asked questions such as “When I borrow money, I re-pay the debt as quickly as possible”.

Following the attitudes survey on money, students then completed a template on Excel that teachers created that asked them to choose if they wanted to buy a home and location, purchase housing, utilities, food, transportation and an emergency fund. In this activity, students realized how fast they money they earned was quickly depleted. One student commented, “Ms., I can’t afford Internet!” and many students realized that they were going to have make trade offs such as renting instead of purchasing a home.

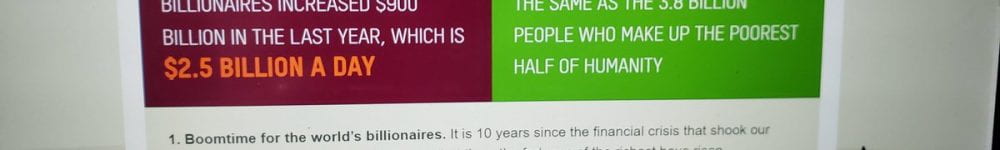

The next part of our unit had students compare earnings for the careers they chose with other people around the world. Students also watched the documentary called: Living on a Dollar a Day and we connected this documentary to the UN Global Goals specifically goal #10 Reducing Inequalities. Since we teach in a Catholic school, we also connected the scripture and our virtues program and students used ScreenCastify to create a reflection on what they learned and what they could do to help reduce inequalities in our world. This led to our next lesson on equity and privilege where I utilized resources from a presentation I attended at the Ontario School Counsellors’ Association conference by presenters Kari Peters and Wayne Loo. We began the lesson with a the privilege throw activity and went into a discussion about how having choice is the hallmark of privilege. We discussed the diffference between the word equity and equality.

The culminating task for the unit was a chance for students to reflect and share what they head learned about in the finacial literacy unit and provide feedback for us as educators. Students presented their findings and reflected on their learning by sharing with classmates what careers they had chosen and why and explain the choices they made financially. Overall, feedback from students and teachers has been overwheleminly positive on the unit. One of the other teachers, Dorothy Gdyczynski I worked with stated: “The students really enjoyed it! They liked budgeting as they had never done that before and it was eye opening. They had a better understanding of how to look at money that would be coming in on a monthly basis”. Erika McCharles another educator I worked with noted that: “I think they were surprised at how fast the money goes and that they get a better understanding of all the expenese their parents have that they had never really thought of before”.

Students feedback at the end of the unit was overwhelmingly positive and many students want to learn more about investing and how to save up for post secondary education and so the teachers and I are working on having someone to come and speak to them to provide tips and answer questions. When I asked the teachers why they felt other educators should teach financial literacy Erica McCharles responded: “Financial literacy, like math and language literacy, is a skill that is learned. If we dont teach them how to think about money and be a smart consumer and make wise financial choices how can they go out into the world with their salary and make wise choices. Sabrina Iannicca stated: “We wanted to create a financial literacy unit for students so they could start understanding the importance of planning for the future. Providing them with an average salary, cost of buying or renting a home, transportation, food; essentially the cost of living, really put things into perspective for them at the end of this unit. Our hope was to better prepare them for tomorrow, and I think they have a good stepping stone.”

Collaborating and putting together this unit was one of the highlights for me this year and seeing it all come together so successfully, I am hopeful to be able to put together further lessons and encourage more teachers I work with to embed some aspect of financial literacy next year into their lessons.